Office Expense Categories . 5/5 (50) You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. You can also deduct bank fees for your business bank account and the cost of accounting software. the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. You can deduct the cost of office expenses. breaking down business expenses into more specific categories, particularly within operating and non. These include small items such as: to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. You can deduct the cost of office expenses that are generally not related to your workspace.

from www.freemicrosofttemplates.com

the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. 5/5 (50) office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. breaking down business expenses into more specific categories, particularly within operating and non. You can also deduct bank fees for your business bank account and the cost of accounting software. These include small items such as: You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. You can deduct the cost of office expenses. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. You can deduct the cost of office expenses that are generally not related to your workspace.

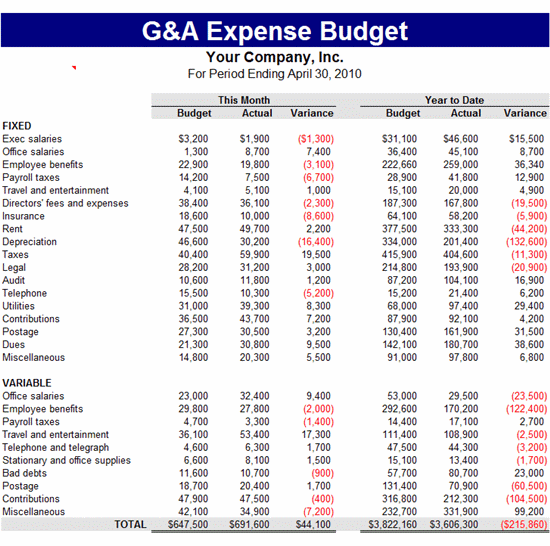

G & A Expense Budget Template ReadyMade Office Templates

Office Expense Categories You can deduct the cost of office expenses that are generally not related to your workspace. 5/5 (50) You can deduct the cost of office expenses. You can deduct the cost of office expenses that are generally not related to your workspace. You can also deduct bank fees for your business bank account and the cost of accounting software. office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. breaking down business expenses into more specific categories, particularly within operating and non. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. These include small items such as: You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce.

From exceltemplate.net

Daily Expense Sheet » Office Expense Categories breaking down business expenses into more specific categories, particularly within operating and non. You can also deduct bank fees for your business bank account and the cost of accounting software. 5/5 (50) You can deduct the cost of office expenses. office expenses are common costs a business incurs that are necessary in order to run the business,. Office Expense Categories.

From www.akounto.com

15 Small Business Expense Categories with Examples Akounto Office Expense Categories to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. breaking down business expenses into more specific categories, particularly within operating and non. You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. the irs allows businesses to deduct. Office Expense Categories.

From happay.com

20 Business Expense Categories List to Consider for Your Business Office Expense Categories You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. These include small items such as: You can deduct the cost of office expenses that are generally not related to your. Office Expense Categories.

From www.excelwordtemplate.com

Expense Report Template Excel Word Template Office Expense Categories These include small items such as: breaking down business expenses into more specific categories, particularly within operating and non. You can deduct the cost of office expenses that are generally not related to your workspace. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. . Office Expense Categories.

From exceltemplate.net

Business Expense Tracker » Office Expense Categories These include small items such as: You can also deduct bank fees for your business bank account and the cost of accounting software. You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give. Office Expense Categories.

From www.pinterest.com

150+ Expense Tracking Categories to Help You Track Your Finances Office Expense Categories to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. These include small items such as: breaking down business. Office Expense Categories.

From happay.com

20 Business Expense Categories List to Consider for Your Business Office Expense Categories You can deduct the cost of office expenses that are generally not related to your workspace. You can also deduct bank fees for your business bank account and the cost of accounting software. the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. breaking down business expenses into more specific categories, particularly. Office Expense Categories.

From efinancemanagement.com

What is Expense? Definition and Meaning Office Expense Categories office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. These include small items such as: You can deduct the cost of office expenses that are generally not related to your workspace. breaking down business expenses into more specific categories, particularly within. Office Expense Categories.

From db-excel.com

Business Expense List Template — Office Expense Categories the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. breaking down business expenses into more specific categories, particularly within operating and non. office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. 5/5 . Office Expense Categories.

From www.sampletemplates.com

FREE 10+ Sample Lists of Expense in MS Word PDF Office Expense Categories office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. You can deduct the cost of office expenses. 5/5 (50) breaking down business expenses into more specific categories, particularly within operating and non. You can deduct office expenses for small items. Office Expense Categories.

From www.pinterest.com

Are you unsure what expenses are deductible for you business? This Office Expense Categories These include small items such as: You can deduct the cost of office expenses. breaking down business expenses into more specific categories, particularly within operating and non. You can deduct the cost of office expenses that are generally not related to your workspace. 5/5 (50) the irs allows businesses to deduct various expenses from their taxable income,. Office Expense Categories.

From online-accounting.net

What are operating expenses? Online Accounting Office Expense Categories You can deduct the cost of office expenses that are generally not related to your workspace. You can deduct the cost of office expenses. 5/5 (50) the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. office expenses are common costs a business incurs that are necessary in order to run. Office Expense Categories.

From support.jupix.com

Expense type categories Jupix Office Expense Categories You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. You can deduct the cost of office expenses that are generally not related to your workspace. You. Office Expense Categories.

From www.youtube.com

Business Expenses Small Business Tax and Bookkeeping 101 inar Office Expense Categories to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. You can deduct the cost of office expenses that are generally not related to your workspace. 5/5 (50) You can deduct the cost of office expenses. breaking down business expenses into more specific categories, particularly. Office Expense Categories.

From corporatefinanceinstitute.com

Expenses Definition, Types, and Practical Examples Office Expense Categories office expenses are common costs a business incurs that are necessary in order to run the business, like purchasing new computer equipment, fax machine, printer, etc. You can also deduct bank fees for your business bank account and the cost of accounting software. These include small items such as: You can deduct the cost of office expenses that are. Office Expense Categories.

From www.bill.com

How to categorize business expenses Office Expense Categories You can deduct the cost of office expenses that are generally not related to your workspace. These include small items such as: 5/5 (50) You can deduct the cost of office expenses. breaking down business expenses into more specific categories, particularly within operating and non. You can deduct office expenses for small items such as pens, pencils, paper. Office Expense Categories.

From www.pinterest.com

Super Helpful List of Business Expense Categories for Small Businesses Office Expense Categories You can deduct office expenses for small items such as pens, pencils, paper clips, stationery, and. You can also deduct bank fees for your business bank account and the cost of accounting software. to help you figure out which costs qualify as business expenses, we’ve listed 28 common business expense categories to give you an. the irs allows. Office Expense Categories.

From www.netsuite.com

Operating Expenses Defined A Business Guide NetSuite Office Expense Categories the irs allows businesses to deduct various expenses from their taxable income, which can substantially reduce. breaking down business expenses into more specific categories, particularly within operating and non. You can deduct the cost of office expenses. 5/5 (50) You can deduct the cost of office expenses that are generally not related to your workspace. You can. Office Expense Categories.